Immigrants won’t Reduce Wage Rates: Here’s why

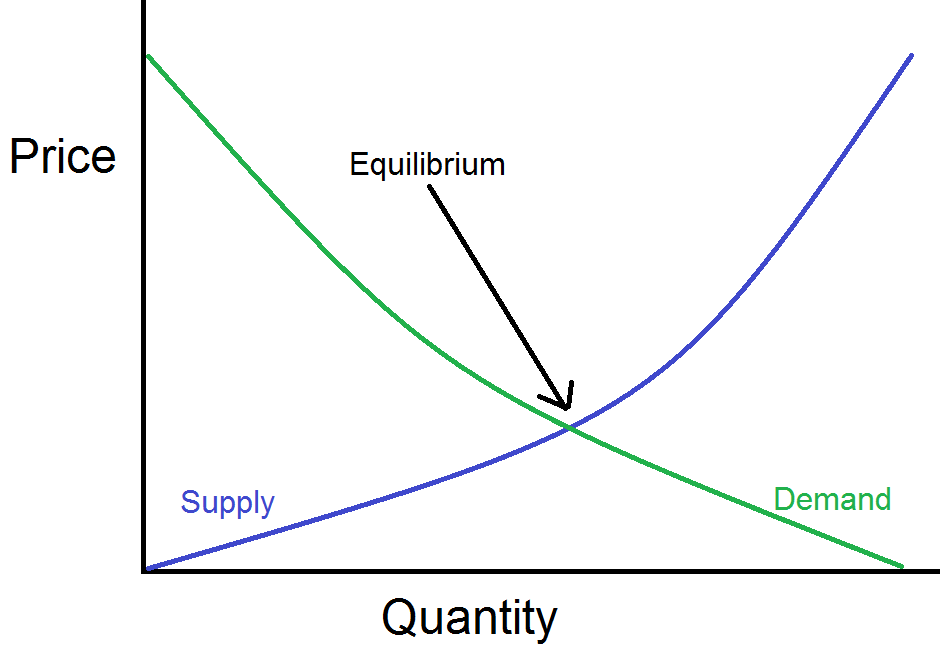

We’re all familiar with the Law of Supply and Demand. There is a supply curve that goes up as price goes up, and a demand curve that goes down as price goes up. It’s often drawn like this:

Using this idea, one would expect immigration to cause wages to fall. It seems obvious. Increasing the supply of labor will push the equilibrium price down. Won’t it?

Not so fast. At best, the supply and demand curves are an approximation. If the market were frozen in time and all variables were somehow fixed except supply, then sure, a rising supply of workers would cause a falling price of labor. Maybe. I call this kind of thinking the most common economic error. Just how are we to freeze the economy the way a camera freezes a scene, and yet change that very economy by adding more workers?

Labor doesn’t work as the so called Law of Supply and Demand predicts. America once had by far the greatest immigration, and at the same time it had by far the fastest wage gains.

There is no such thing as Economic Photoshop.

Static thinking is tempting because it’s easy and seems to appeal to common sense. To borrow a phrase coined by Wolfgang Pauli, it’s not even wrong.

As with every kind of aggregate quantity that economists like to measure, supply and demand are not forces that impel market participants. Hiring managers don’t input the quantity of workers into an equation, and get the wage from that. They’re concerned with something quite different, and much easier. They want to make a profit.

Suppose a worker can make 10 hamburgers an hour. The non-labor costs add up to $3.50, and the customer is willing to pay $5.00. A simple calculation tells the manager that a worker will generate $15.00 per hour {($5.00 – $3.50 = $1.50) x 10}. He therefore cannot pay more than $15, or even close to that. He has to offer at least $8 to attract workers. That leaves him a tight profit margin because there are work breaks and slow times during the day.

The supply-and-demand proponent will at this point ask, “Well, if you add more workers competing for the same job, won’t the hiring manager be all too happy to pay less than $8?” That’s the same fallacy I described above. It presumes that we can hold constant the number of restaurants, burger-eating consumers, and even the percentage of meals people eat out. We cannot presume that we can change only the number of workers.

Labor doesn’t work as the so called Law of Supply and Demand predicts. America once had by far the greatest immigration, and at the same time it had by far the fastest wage gains. To understand why, we have to look at what supply-demand concepts are trying to approximate.

Marginal utility.

Let me explain. The first unit of a good is bought by the consumer who places the highest value on it. For example, bakeries have long bought wheat to make bread. No higher use of wheat exists than eating it. We need food to live.

When farmers increased efficiency and output, then pet companies could put wheat into dog food. With further price cuts, home decor companies could put wheat into wallpaper paste. As it gets cheaper still, toymakers could make it into a sculpting material for toddlers. And so on (these examples are just my suppositions, so take them with a grain of salt).

The price of wheat is set by this marginal user, because that’s the buyer who will walk away on the first uptick. In other words, in the hypothetical illustration above, the price of wheat is determined by what the maker of Play-Doh can afford to pay.

If farmers can produce even more and sell it to the market, who knows what the next lower use of wheat is? Maybe someone will make recyclable boxes out of it.

Before the Industrial Revolution, the vast majority of people worked as laborers in agriculture. The work was not only back-breaking, but offered very low value. Ever since then, developed economies have employed more and more people. But they are not employed in lower and lower jobs.

The principle for every commodity is the same. As more is produced, the price has to drop to accommodate the next lower use. The marginal utility of wheat declines. So does the marginal utility of copper, crude oil, iron ore, and every other commodity (except gold, but that’s a different discussion altogether).

People say that the price has to fall to find a new equilibrium on the demand curve, but they do not see the cause, which is declining marginal utility. They see only the effect.

This brings us to human labor. Is work like wheat, descending from high uses to ever-lower uses?

No.

The exact opposite is true. Before the Industrial Revolution, the vast majority of people worked as laborers in agriculture. The work was not only back-breaking, but offered very low value. Ever since then, developed economies have employed more and more people. But they are not employed in lower and lower jobs for them (question: what’s lower than mucking out a stall for a horse?) They are employed in higher and higher jobs. Work is so advanced today, we produce such high-value products, that people from the 18th century could not have even imagined it.

The marginal utility of human work does not diminish as the number of workers increases. As the size of a market grows, the value of firms and workers within it rises.

Essentially a larger market allows more and more specialization, and more innovation, both of which have the effect of increasing the marginal output of labor.

Bringing more immigrants into the country will not diminish wage rates. It never has.

« “One Percent” Sanders: Do the Math Jacquie Trims Her Manicure (Fiction) »