Translating deep thinking into common sense

The Case for Sovereign Gold Bonds

By Keith Weiner

June 29, 2018

SUBSCRIBE TO SAVVY STREET (It's Free)

A gold bond is a debt obligation that is denominated in gold, with interest and principal paid in gold. As I will explain below, it’s a way for the issuer to pay off its debt in full, and there are other advantages.

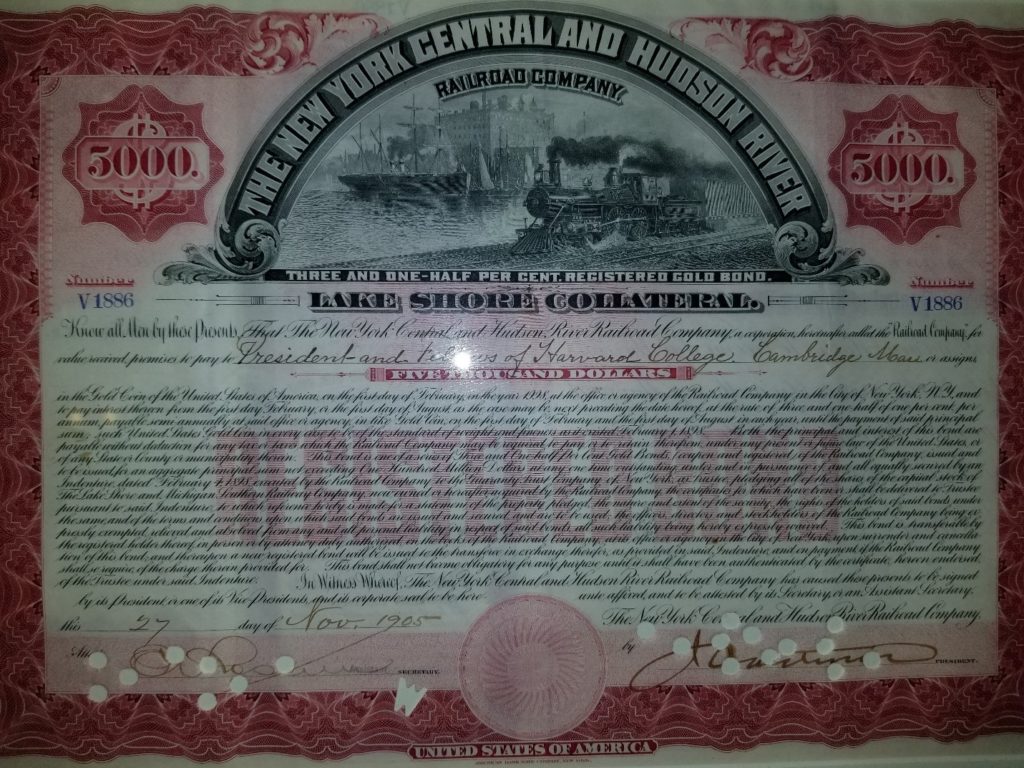

Sometimes, I find that it’s helpful to show a picture of what I’m talking about. At the Harvard Club in New York, an old gold bond is hanging on the wall among other memorabilia.

Photo: Keith Weiner

Photo: Keith Weiner

This is a gold bond bought by the President and Fellows of Harvard College, on 27 Nov 1905. The amount is $5,000 payable in “the Gold Coin of the United States of America.” That coin was the Liberty Head. The double eagle $20 coin had just under 1 troy ounce (i.e. 31.1 grams), or 0.05oz per dollar. Thus $5,000 meant 241 7/8 ounces.

The interest rate was 3.5 percent, paid semiannually until the principal was to be returned on 1 Feb 1998—a 92-year maturity. This may seem incredible, but the gold standard had a stability that we can only dream of today.

Unfortunately, less than 30 years later President Roosevelt decreed all gold clauses void. In 1998 (assuming the bond hadn’t defaulted), Harvard was finally paid $5,000. This is a loss of 93% of its original investment, as it was then worth less than 17oz gold.

There has not been a gold bond in the U.S. for 85 years. Yet one government (which I will be able to talk about soon) is moving towards issuing gold bonds. I have written tens of thousands of words on the benefits of gold bonds to investors. Today, in light of this impending momentous event, I am writing about the benefits to the issuer of the bond, including government issuers. There are also benefits to mining companies within the jurisdiction of the issuing government.

Benefit to Government

The Federal Reserve has a policy of two percent per annum debasement of the US dollar. Other central banks around the world have similar targets, for example both the Bank of England and the European Central Bank set their targets at two percent. Creditors should prefer gold assets over dollar-, pound-, and euro-denominated assets because gold is not subject to this debasement. The 10-year Treasury yields 2.9% as I write this. Assuming that the Fed hits its target without overshooting it, then the central bank is robbing the investor of most of their return.

For the very reason that creditors should avoid dollar assets, shouldn’t debtors prefer dollar liabilities? Isn’t it good to borrow in a falling currency? Repaying in devalued dollars should ease the burden of debt.

However, this leads to a question. For the very reason that creditors should avoid dollar assets, shouldn’t debtors prefer dollar liabilities? Isn’t it good to borrow in a falling currency? Repaying in devalued dollars should ease the burden of debt. In 2001, the dollar was worth over 122 milligrams of gold. By 2011, it had declined to less than 16mg. Any gold producer who borrowed dollars in 2001 could repay that debt for 87% less gold.

Matching Gold Debt to Gold Income

There’s just one problem. The decline is not smooth, but quite volatile. The dollar can go up, sometimes sharply (as in 2013). By 2015, the dollar was up to about 30mg. Any gold producer who borrowed dollars in 2011 would have to pay 90% more gold just four years later.

If a debtor has a dollar income (as nearly everyone does) then it can ignore the dollar’s ups and downs. When the dollar goes down, both income and expense goes down. When the dollar goes up, income and expense go up.

However, if your income is gold, then any drop in the price of the metal can strain your capacity to pay your dollar debts. A falling price of gold is just the flip side of a rising dollar.

Debt should be matched to the income that services it. If the income is gold, then the debt should be gold. And if you’re a government which taxes gold mining activity, your income is gold. This is true, whether the tax is remitted in gold metal, or whether the miner pays the equivalent value of the metal in dollars. If the price of gold drops, then your revenue drops. If you have dollar-denominated debt, then a gap will open up in your budget.

By issuing gold bonds, and replacing dollar-denominated debt with gold debt, the government stabilizes its debt obligations and de-risks its debt service. If the price of gold goes up, or if it goes down, both the tax revenues and debt payments move together.

It’s always good to reduce risk, but doubly so in our present economic environment.

A Mechanism to Get out of Debt

Let me address a common misconception up front. Many tend to think of a “gold backed” bond. That’s just a conventional dollar bond with gold as collateral. It’s a way to use gold to go deeper into debt, and I won’t address it further.

Debtors are sinking deeper into debt. Paying off debt becomes harder and harder, while borrowing gets more tempting with each drop in the interest rate. Pretty soon, even in a sparsely populated jurisdiction, the debt burden reaches thousands of dollars per capita.

Sell the gold bond, not for dollars or for gold, but for conventional bonds. Require buyers to redeem outstanding bonds in exchange for new gold bonds. It’s a way to replace existing dollar-denominated bonds with gold bonds.

Fortunately, there is an elegant mechanism to get out of debt. Sell the gold bond, not for dollars or for gold, but for conventional bonds. Require buyers to redeem outstanding bonds in exchange for new gold bonds. It’s a way to replace existing dollar-denominated bonds with gold bonds.

This will establish a paper bond to gold bond exchange rate. The exchange rate will, of course, reflect the dollar to gold exchange rate. Plus, it will also incorporate the market’s expectation that the price of gold will rise during the term of the bond. A significant premium will likely develop, especially during times when the price of gold is rising.

The government can use this mechanism to retire more debt than its tax revenues would otherwise allow. It can retire more and more dollar debt for the same gold-denominated debt.

For example, if the price of gold is $1,300 per ounce, then a 1,000-ounce gold bond should exchange for $1,300,000 worth of conventional paper dollar bonds. However, a bond matures in years or decades. If the market thinks that the paper dollar will depreciate—if the market believes the Fed’s stated policy—then it will assess gold to be paid in the future a higher value than dollars to be paid in the future. In this case, the market could offer $1,500,000 worth of conventional paper bonds.

It’s not free money, but it’s the next best thing—selling gold for more than the price of gold.

Lower Interest Expense

The credit rating agencies are likely to respond favorably to the issuance of gold bonds. This is because matching the debt to the income reduces the risk of a change in the gold price. A higher rating will result in a lower interest rate, as the market perceives lower risk.

There may be another reason for the interest rate on gold bonds to be lower than that on paper bonds. If market participants can express a preference for gold bonds over paper bonds, then they will push up the price of the gold bond until it’s higher than the comparable paper bond. A higher bond price means a lower interest rate. A lower rate means a lower financing cost borne by the issuer.

One thing is surely true. A gold bond will bring investors from around the world. Demand for the issuer’s gold bond will be much greater than it ever was for their conventional dollar bonds. This inflow of capital will push down the cost. This is a different argument to reach the same conclusion. Interest rates will likely be lower, and hence costs.

Other Benefits to the Gold Bond Issuer

Something else will come into the first jurisdiction to issue a gold bond: a growing gold financial sector. Gold finance companies (like my company, Monetary Metals), traders, brokers, and many others will establish their offices where the action is. This brings high-paying jobs, real estate utilization, tax base, business travel, prestige, and GDP growth—everything that a government could want.

There is one more major benefit. Government workers’ pension programs are typically underfunded. This means that the assets in the fund are insufficient to pay out all benefits when due. Pensions find themselves in this predicament for two reasons. One, dollar debasement forces the pension to increase its payout due to cost of living adjustments. However, there is no guarantee that investment returns increase with the cost of living.

Two, the interest rate has been falling for decades. A pension fund gathers money collected from workers’ paychecks plus employer contributions. The payout amounts were based on an assumption of what interest rate the fund will likely earn in the future. After decades of falling rates, the market is paying a much lower yield than what pension funds assumed.

Adding an allocation of gold bonds to the pension fund portfolio will help shore it up. Gold is not subject to debasement. Nor is the gold interest rate. Actuaries can count on gold in a way that is not possible with the dollar.

Gold Miners Also Benefit

Most of the above, describing the benefits to a government issuer of gold bonds, apply equally to a gold mining company that issues gold bonds. In this section I want to address the benefits to a mining company, simply for being in a jurisdiction where the government has issued gold bonds.

Reduces Political Risk to Miners

The first benefit is reduced political risk. Governments today have a love-hate relationship with the resource extraction sector. On the one hand, they depend on the tax revenues. On the other hand, environmental activists always agitate to shut down mining and drilling. When a government issues gold bonds, it now depends on the gold revenue it receives from the mining companies. This revenue cannot be substituted for dollar revenue from sales, income, or property taxes. The government will no longer entertain shutting down the gold mining sector.

This is not the traditional dependency, which has hurt gold miners when the price of gold has dropped. The government, financed entirely with conventional dollar bonds, has an interest payment fixed in dollars. If the gold price drops, then the government has a shortfall. So, just at a time when the miner’s profit margins are compressing, the government proposes an unwelcome idea: increasing the mining tax rate.

However, under gold bond financing, the government never has an unplanned deficit due to a gold price drop. And therefore, its interests are better aligned with the mining companies operating in its jurisdiction.

Breaking the Ice

One question has been asked by government officials in private discussions. If this is such a good idea, why hasn’t it been tried before? I am reminded of the joke that two economics professors are walking on campus when they spot a $100 bill lying on the road. As one bends to pick it up, the other says “you fool—if it were real, then others would not have left it for us to find!”

When a sovereign government issues a gold bond, it opens the market for gold bonds. This creates an option for gold mining companies. Today, mining CFOs may understand that financing gold production with gold debt reduces risk and volatility. Yet lingering uncertainty about the demand for gold bonds or market liquidity, may also cast a cloud over the possibility. Mining companies may not wish to risk trying to create a market on their own. With the first regional government issuing a gold bond, these concerns will be eliminated—quite dramatically.

I think it’s pretty obvious that the use of gold for repayment of bonds will increase the demand for gold. This does not necessarily mean that the price of gold will shoot up by $1,000 an ounce overnight (though a pop in the price is likely).

A Paradigm Shift

However, something needs to be said. The gold bond shows the market that there is a shift to a new paradigm. In this new paradigm, gold has a monetary use which it does not have today.

Everyone loves gold jewelry, but as a financial asset it is tarred by history from presidents Roosevelt to Nixon, not to mention dealers who peddle it as a get-rich-quick scheme. As a result, most mainstream investors won’t touch gold.

Further, gold gains respectability that it may lack right now. Everyone loves gold jewelry, but as a financial asset it is tarred by history from presidents Roosevelt to Nixon, not to mention dealers who peddle it as a get-rich-quick scheme. As a result, most mainstream investors won’t touch gold. Warren Buffet has famously said, “If you own one ounce of gold for an eternity, you will still have one ounce at its end.” Gold has not paid interest in many decades.

The gold bond will lead to a sea change in attitudes. With that change will come higher gold prices. Unlike an increase in the general price level, there will not be an increase in the costs of gold mining, such as oil and labor.

A sustained higher price for the metal, as opposed to just another temporary blip, not only increases profit margins on existing production. It also enables expansion of production, within the gold bond jurisdiction and anywhere else that the mining company has gold resources.

The gold bond will come with a new option in the tax code. Miners will have the choice to pay their taxes in gold. While this would require miners to change their existing business processes and systems, it could unlock significant savings. If there is any delay between when the tax office assesses the tax and when the gold is sold, the company must hedge the price risk. Hedging adds moving parts, complexity, cost, and its own risks.

Workers and Mining Union Benefit

Workers and their unions are better off in an environment of rising production volumes, rising margins, rising employment, and rising profits. When business is doing well, everyone benefits. There are opportunities for overtime, promotions, bonuses for bringing friends to job openings, etc.

In an environment of risk-taking for exploration and development of new resources, there are opportunities for bonuses and even equity participation. It is far better to work in times of industry growth than in times of belt-tightening.

Mine worker pension funds are in the same boat as all other pension funds. Gold bonds are a great asset that they should hold.

Conclusion

Without predictions of hyperinflation or economic doom, without a makeover of the monetary system, and without even a skyrocketing gold price, there are simple and clear fiscal benefits to a government that issues a gold bond. There are also benefits to the people and the gold mining community in that government’s jurisdiction. And it even benefits government workers and retirees who depend on the pension fund.