Translating deep thinking into common sense

Will Bitcoin Survive the Feds and End the Fed?

By Dale B. Halling

September 7, 2017

SUBSCRIBE TO SAVVY STREET (It's Free)

There have been other attempts to create private digital money, however, most of them suffered from being centralized. When digital currencies have a central location, such as a central server, they become targets for hackers and governments.

“Bitcoin is Evil.” This is the title of a Paul Krugman New York Times article from 2013. Krugman is a Nobel-prize winner in economics. He soft pedals his complaints about Bitcoin, but high on his list is that Bitcoin could undermine the ability of the Federal Reserve (and the U.S. Treasury) to manipulate the money supply to “manage” the economy. Not surprisingly, many libertarians like Bitcoin for exactly the same reasons Krugman hates it. However, not all libertarians and Austrian economists like Bitcoin. For instance, Peter Schiff is no fan of Bitcoin, he thinks “Bitcoin Is A Speculative Frenzy.”

Bitcoin is commonly described as a digital currency. But what does that mean? The U.S. dollar and the currencies of all major economies are also digital currencies, at least in the sense that most U.S. dollars are just digital entries. As I showed in the article “What is Money”, money is just an accounting entry (computer entry) and a generalized I Owe You. Bitcoin, however, is not a government created or backed currency and the total number of Bitcoins that can ever exist is mathematically limited to around 21 million. On the other hand, nothing stops the United States (or other governments) from creating an unlimited number of dollars.

There have been other attempts to create private digital money; however, most of them suffered from being centralized. When digital currencies have a central location, such as a central server, they become targets for hackers and governments.

Satoshi Nakamoto published a paper laying out the Bitcoin technology in 2008 and released open source software to implement Bitcoin in 2009. Nakamoto’s paper lays out a peer-to-peer or decentralized digital ledger, meaning there is no central point of failure or place to attack. The technology is not really about coins so much as it is about a public accounting ledger that keeps track of all these Bitcoin IOUs. In Bitcoin, the transactions are encrypted, but more importantly new transactions are linked to the earlier transactions and the ledger is encrypted. This is called block chain technology. Bitcoin has never been hacked. Some exchanges that trade Bitcoin have been hacked, but not Bitcoin. If you want to understand the underlying technology better, see “How Bitcoin Works.” One of the interesting facts about Bitcoin is that no one knows who Satoshi Nakamoto is to this day, despite efforts to find him.

A number of complaints have been raised against Bitcoin. Perhaps the most prevalent is that Bitcoin has no intrinsic value. In my article “What is Money,” I show that no currency has intrinsic value. However, what people mean by this statement is that Bitcoin is not backed by some physical asset. Of course this is true of almost all government currencies today. Many gold bugs (gold enthusiasts who advocate people should hold gold and our money should be backed by gold) have been critical of Bitcoin, arguing that is speculative and that gold has real value. However, almost no one has a real use for gold and you cannot eat or drink gold. The gold is just a way to have a claim on future goods and services that many people recognize.

Many Bitcoin advocates call Bitcoin “digital gold.” Gold advocates will point out that Bitcoin has been around less than a decade and people have been using gold as currency for at least three millennia. It is interesting to compare and contrast Bitcoin with gold. Bitcoin’s total quantity is limited mathematically. Gold is limited and very hard and expensive to mine. Gold is durable. Bitcoin’s peer to peer network is likely to be as durable as the Internet. Gold is easily divisible. Bitcoin can be divided down to eight decimals. Bitcoin transactions can be fairly anonymous and this is true of gold transactions in person, but not of international transactions. There are advantages and disadvantages to both.

Gold bugs have been telling us at least since 2009 that gold and silver are going to appreciate because of the inflation created by central banks. However, gold prices are essentially the same today as they were in 2009. This is not because there has been no inflation in the United States, for instance. Some people claim there has been central bank manipulation of the gold market or have other conspiracy theories. I believe a close look at gold production explains why this is occurring.

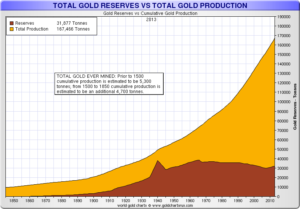

Chart from https://www.goldbroker.com/news/above-ground-gold-stock-how-much-is-there-why-does-matter-546

From this chart we can see that the total amount of gold mined is increasing over time. This is most likely because new mining technology has made it less expensive and faster to mine gold. The result is that gold prices have been held in check by this ready supply of new gold.

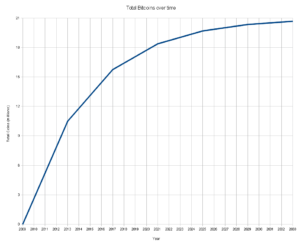

As opposed to gold’s increasing production over time, Bitcoin’s production of coins is declining over time as the chart below shows.

Chart from https://bitcoin.stackexchange.com/questions/161/how-many-bitcoins-will-there-eventually-be

From these charts I think it is clear why Bitcoin is going up in price and gold is holding steady. Of course, competitive crypto-currencies can and are being created. Not all of these other so-called crypto-currencies have the same goals as Bitcoin. Many use the same basic technology, called “block chain” technology, to issue coins that act like a stock or a bond. Other coins are designed to store and record information securely, such as property deeds, votes, medical records, or other ledgers. Still other coins are designed to create digital contracts. Perhaps the easiest way to understand this is to think of them as a digital escrow.

Recently there have been a number of companies that are using this block chain technology to secure computer files. If you store your files using this technology, your files are intrinsically backed up all over the internet, can be reached all over the internet, and your information is stored more securely than previous encryption techniques.

Many block chain enthusiasts think that this technology is in its infancy and that it will have a huge impact on the economy. They make an analogy to the Internet in say 1993. Libertarians argue that Bitcoin has the potential to undermine all fiat currencies and end central banks. Some people fear that if this happens the valuable function that banks perform in aggregating loans and freeing up capital will be lost. These people are mistaken. There are many ways that Bitcoin or related coins can fulfill this function. One of the easiest is to have a debt coin (often alternate coins like this are called colored coins) that represents a portion of a mortgage (group of mortgages) or a car loan(s). The debt coin is issued in exchange for Bitcoins to buy a house and the market decides whether people want to fund this loan. When the loan is paid back the debt coin ceases to exist, just like a bond that has been paid off. If the debt holder(s) are paying on time, these debt coins can circulate as a currency. A real life example of this was the Bitfinex BFX token which was used to make customers’ accounts whole when Bitfinex was hacked and some of the Bitcoin they were holding was stolen. This allows the supply of digital currencies to expand and contract with the assets in the economy. Bitcoin however is like gold was, it does not expand and contract with the economy.

Will Bitcoin live up to the libertarian utopia of killing off fiat currencies and central banks? Is block chain technology the next disruptive technology wave? We will have to wait and see.

A number of countries have declared Bitcoin as a legal currency, including Japan and South Korea. Australia seems likely to follow. None of these countries have declared Bitcoin legal tender, but their laws will treat Bitcoin as a currency instead of an asset. This is important because if a country treats Bitcoin as an asset, then you have to calculate a profit or loss on your Bitcoin for every transaction. This makes it pretty painful to use Bitcoin to buy a cup of coffee or even to pay the rent.

Will Bitcoin live up to the libertarian utopia of killing off fiat currencies and central banks? Is block chain technology the next disruptive technology wave? We will have to wait and see.